Business Knowledge For It In Trading And Exchanges Pdf Viewer

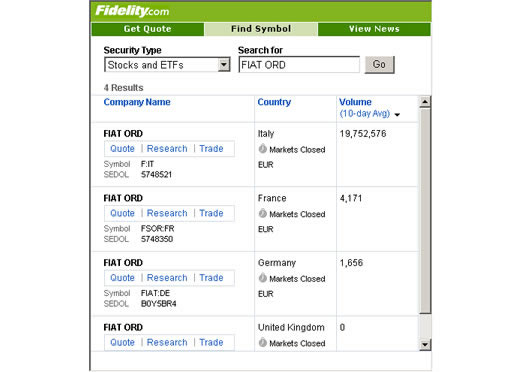

Exchanges such as the New York Stock Exchange (NYSE), where most of the action takes place on a trading. 6.pdf?sequence=1 (describing the differences between the stock exchanges and issues related to trading. Best algorithms are worth a fortune; and traders in the HFT business must be aware of attempted theft.

- Business Knowledge For It In Trading And Exchanges Pdf Viewer Download

- Business Knowledge For It In Trading And Exchanges Pdf Viewer Free

Foreign exchange trading was once something that people only did when they needed foreign currency to use when traveling in other countries.

This involved exchanging some of their home country's currency for another at a bank or foreign exchange broker, and they would receive their foreign currency at the current exchange rate offered by the bank or broker.

These days, when you hear someone refer to foreign exchange trading or forex, they are usually referring to a type of investment trading that has now become common. Many people wonder how foreign currency trading, often shortened to forex trading, works because they're interested in learning how to trade currencies for themselves.

Just like with trading stocks, forex traders can speculate on the fluctuating values of currencies between two countries, and it's done for entertainment and profit.

The Forex Market for Beginners

It seems like something that most people would find easy, except, in this particular industry, there is a high rate of failure among new traders because there is quite a steep learning curve.

Even traders that are aware of that tend to start out with the attitude of 'It happened to them, but it won't happen to me.' In the end, 96 percent of these traders walk away empty-handed, not quite sure what happened to them, or maybe even feeling a bit scammed.

Forex trading is not a scam; it's just an industry that is primarily set up for insiders that understand it. The goal for new traders should be to survive long enough to understand the inner working of foreign exchange trading and become one of those insiders, and this will come with studying the market, understanding the terminology, and learning trading strategies.

Forex and Leverage

The number one thing that hangs most traders out to dry is the ability to use a trading feature called forex trading leverage. Using leverage allows traders to trade in the market using more money than what they have in their account.

For example, if you were trading 2:1, you could have a $1,000 deposit in your brokerage account, and yet control and trade $2,000 of currency on the market. Many forex brokers offer as much as 50:1 leverage. This can be dangerous, as new traders tend to jump in and start trading with that 50:1 leverage immediately without being prepared for the consequences.

Trading with leverage sounds like a really good time, and it's true that it can increase how easily you can make money, but the thing that is less talked about is it also increases your risk for losses.

If a trader with $1,000 in their account is trading with 50:1, this means they would be trading $50,000 on the market, with each pip being worth around $5. If the average daily move of a currency pair's price is 70 to 100 pips, in a day your average loss could be around $350. If you made a really bad trade, you could lose your entire account in three days, and of course, that is assuming that conditions are normal.

Most new traders, being optimistic, might say 'but I could also double my account in just a matter of days.' While that is indeed true, watching your account fluctuate that seriously is very difficult to do. Many people start out assuming that they can handle it, but when it comes down to it, they don't, forex trading mistakes are made, and accounts are emptied.

The Market and Your Emotions

Assuming that you can manage not to fall into the leverage trap, the next big challenge is to get a handle on your emotions. The biggest thing that you'll tackle is your emotion when trading forex. The forex market can behave like a rollercoaster, and it takes a steel gut to cut your losses at the right time and not fall into the trap of holding trades too long. Forex trading should be a formula and a method that is enacted consistently and without emotion.

Business Knowledge For It In Trading And Exchanges Pdf Viewer Download

When traders become fearful because they have money in a trade and the market's not moving their way, the professional sticks to her trading method and closes out her trade to limit her losses. The novice, on the other hand, stays in the trade, hoping the market will come back. This emotional response can cause novice traders to lose all of their money very quickly.

Business Knowledge For It In Trading And Exchanges Pdf Viewer Free

The availability of leverage will tempt you to use it, and if it works against you, your emotions will weigh on your decision making, and you will probably lose money. The best way to avoid all of this is to develop a trading plan that you can stick to, with methods and strategies you've tested and that result in profitable trades at least 50 percent of the time. In fact, not only should you have a trading plan, but you should keep a forex trading journal as well to keep track of your progress.

The Bottom Line

The forex market works very much like any other market that trades assets such as stocks, bonds or commodities. The way you choose to trade the forex market will determine whether or not you make a profit. You might feel when searching online that it seems other people can trade forex successfully and you can't. It's not true; it's just your self-perception that makes it seem that way.

A lot of people trading foreign exchange are struggling, but their pride keeps them from admitting their problems, and you'll find them posting in online forums or on Facebook about how wonderful they are doing when they are struggling just like you.

Understanding the forex market and winning at trading forex online is an achievable goal if you get educated and keep your head together while you're learning. Practice on a forex trading demo first, and start small when you start using real money. Always allow yourself to be wrong and learn how to move on from it when it happens. People fail at forex trading every day because they lack the ability to be honest with themselves. If you learn to do that, you've solved half of the equation for success in forex trading.